salt tax cap married filing jointly

Married Filing Separately Statute Not Open for Interpretation. Prepare and eFile your 2021 Taxes by April 18 2022.

State And Local Tax Salt Deduction Salt Deduction Taxedu

Taking itemized deductions allows taxpayers who qualify to deduct more from their adjusted gross income AGI than they could using the standard deduction.

. But TCJA limits the SALT deduction to 10000 or just 5000 if youre married but file a separate tax return. Special Offers View All. With the passage of the TCJA the SALT deduction is now limited to 10000 5000 if married and filing separately.

The personal exemption put in place by the TCJA has risen for tax year 2021 to 25100 for married couples filing jointly. This cap applies to state income taxes local income taxes and property taxes combined. Tax Rate Married Filing Jointly or Qualified Widower Single Head of Household.

SALT Cap is Constitutional. Their address is. In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100.

20549 SCHEDULE 14A Rule 14a-101 SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14a of the Securities Exchange Act of 1934 Filed by the Registrant x Filed by a Party other than the Registrant Check the appropriate box. SALT If any of these situations apply it is easy to take some deductions from the taxes that you have to pay. This can be a real problem for people in states with high income or property.

Penalty for Early Withdrawal of IRA. John and Mary Jane sanders are married filling jointly. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married.

They expect to sell 37500 swim caps. Married Filing Jointly 24400. 22 2017 established a new limit on the amount of state and local taxes SALT that can be deducted on a federal income tax return.

Which is the year they got married. It increases the deduction through 2030 from 10000 to 80000 40000 for married filing separately and trusts and estates. Tax Rate Married Filing Jointly or Qualified Widower Single Head of Household Married Filing Separately.

If you are in a high-tax state and will hit the 10000 SALT. Bb The standard deduction is 15 percent of income with a minimum of 1550 and a cap of 2350 for single filers and married filing separately filers. Individual homeowners have a cap of 250000 while married couples have a cap of 500000.

My other itemized deductions come to 20030 and if you cap off the state taxes at 10000 that would give me 30030 in itemized deductions which would be more than the standard. This increased standard deduction may or may not make it worth your while to itemize your return to get the break the mortgage interest deduction can bring. UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington DC.

The federal tax reform law passed on Dec. Married couples can either check the married filing jointly or married filing separately box those are the only two choices in most cases. Known as a dependent care FSA parents can set aside as much as 5000 if filing a joint tax return 2500 for single filers that can be spent on qualifying dependent care expenses.

Each cap sells for 10 and has a contribution margin of 6. The dependent personal exemption is structured as a tax credit and begins to phase out for taxpayers with income exceeding 200000 head of household or 400000 married filing jointly. Our publications provide fast answers to tax questions for tax practitioners.

25900 for single fliers and those who are married filing jointly. For Tax Year 2026 the mortgage interest cap goes back to home mortgage interest paid on all mortgages 1000000 or lower. The 2021 applicable dates of the tax increases mean that New York taxpayers must quickly consider the impact.

For tax purposes the MACRS class life is 5 years. The optional pass-through entity tax is intended as a work-around of the federal 10000 cap on the state and local tax itemized deduction. For single taxpayers and those who are married and filing individually the cap is now 375000 which was 750000 in pre-TCJA years.

Their operating leverage is 3. If you sell your home you can still exclude up to 250000 from capital gains taxation 500000 if Married Filing Jointly if you owned and used the home as a primary. The calculator automatically determines whether the standard or itemized deduction based on inputs will result in the largest tax savings and uses the larger of the two values in the estimated.

Up from 110000 to 400000 for married filed jointly households These two provisions expand both the value of the credit as well as the number of individuals able to claim the credit. Sale of Livestock on Account of Drought. The computer equipment has a useful life of 10 years and a salvage value of 3000.

Preliminary Proxy Statement. SALT includes state and local income tax paid state sales tax paid and property taxes paid. Be aware however there is a strong movement in the Senate led by Senator Bernie Sanders I-Vt to limit the application of any SALT relief to taxpayers with income below specified amounts.

State and local tax deductions are limited to 10000 per year. Deductions for state and local sales tax SALT. The Tax Cuts and Jobs Act made several major changes to the individual income tax which will simplify the tax filing process for millions of households.

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

Opinion The Debate Over A Tax Deduction The New York Times

What Is The Salt Deduction H R Block

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

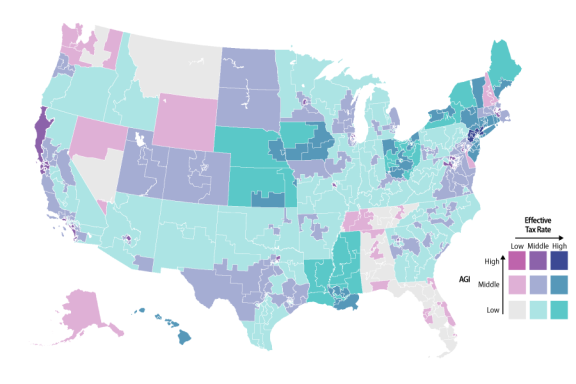

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Opinion What The Salt Deduction Means For The Middle Class The Washington Post

The Salt Cap Overview And Analysis Everycrsreport Com

What Is The Salt Deduction H R Block

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

The Salt Cap Overview And Analysis Everycrsreport Com

Tpc Analyzes Five Ways To Replace The Salt Deduction Cap Tax Policy Center