salt tax repeal march 2021

The prudent course does appear to be to properly elect if applicable and pay by Dec. Financial Planning Tax Planning.

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

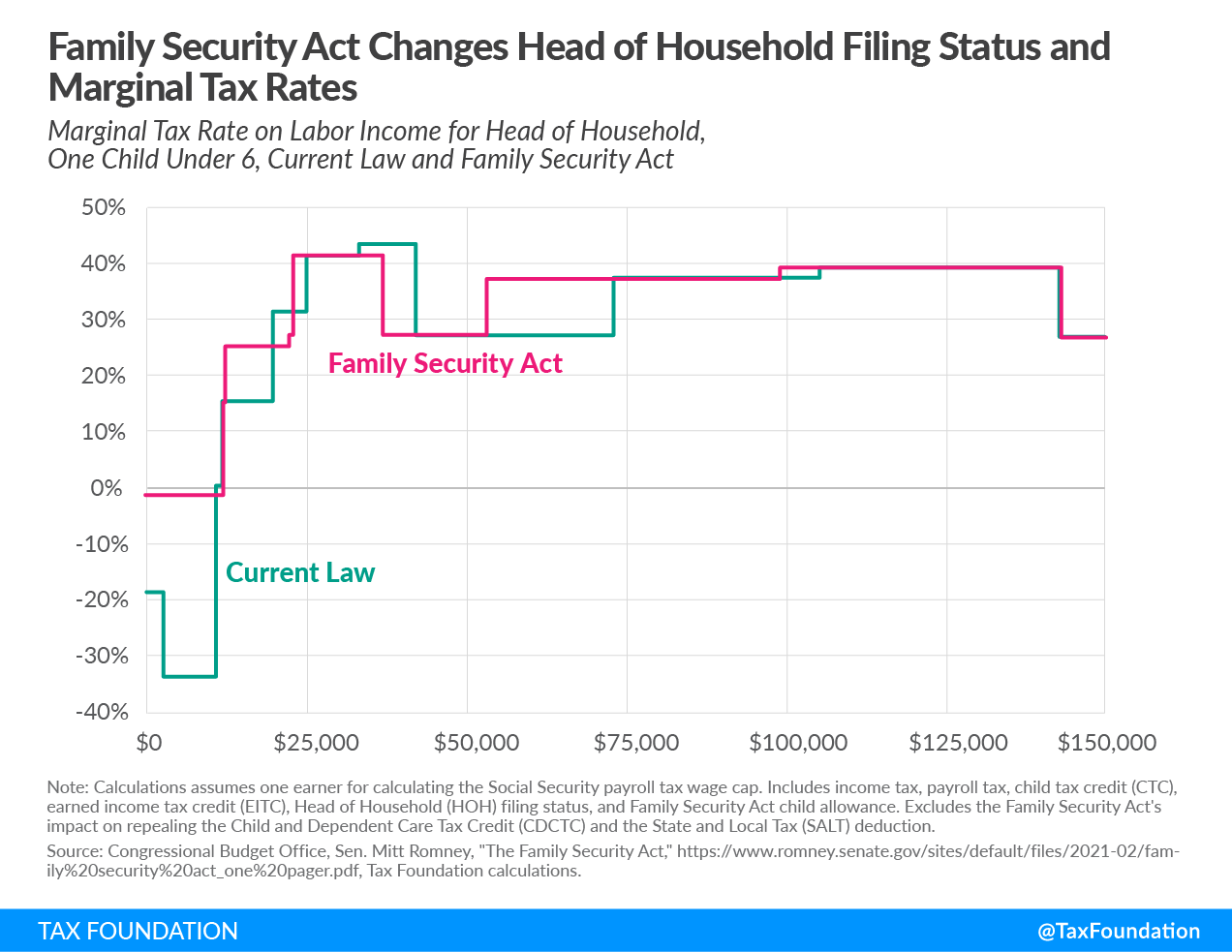

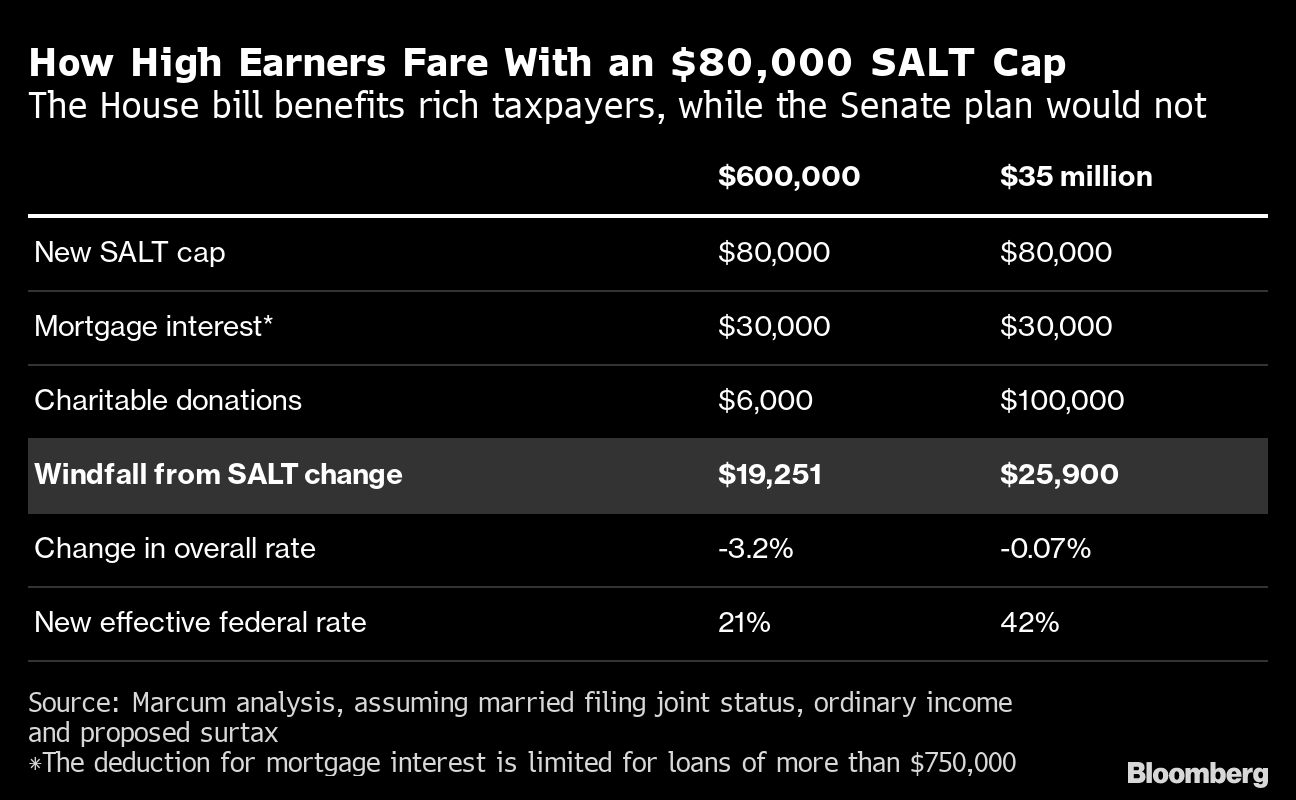

The nonpartisan Tax Policy Center found that if the SALT cap were to be repealed entirely 70 percent of the benefits would go to people with annual incomes above 500000.

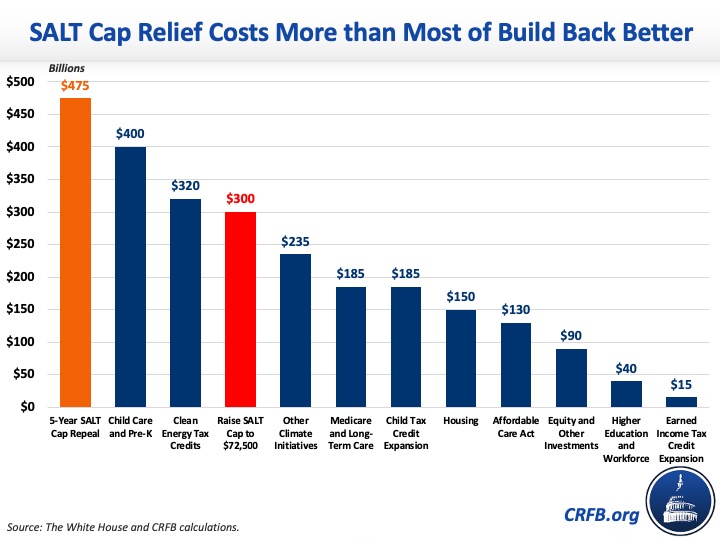

. A vocal contingent of congressional Democrats in high-tax states have pressed for the proposed 35 trillion package to raise the cap on federal tax deductions for paid state and. It would cost 887 billion to repeal the cap in 2021 an amount that could eat into Bidens other priorities. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

Joe Manchin D-WVa raised broader objections to President Bidens social spending and. This significantly increases the boundary that put a cap on the salt deduction at 10000 with the tax cuts and jobs act of 2017. Salt tax repeal 2021 retroactive Saturday October 15 2022 Edit.

For your 2021 taxes which youll file in 2022 you can only itemize when your. The change may be significant for filers who itemize deductions in. SALT-Cap Repeal Gains Momentum.

While 96 percent of the repeals savings would go to the top fifth of earners the middle 60 percent of earners would save an average of 27 annually Brookings found. Salt Tax Cap Repeal 2022. March 29 2021 900 AM.

A rollback of the cap on the state and local tax SALT deduction is on ice after Sen. Salt Tax Cap Repeal 2021. The highlights of the new law include a phase out of the New Jersey estate tax by January 1.

52 rows The SALT deduction is only available if you itemize your deductions using Schedule A. 31 2021 depending on the state PTE regime in order to benefit from the SALT cap. Today Congressman Tom Suozzi D-Long Island Queens issued the following statement.

No SALT no deal. The SALT outlook for 2021. The tax cuts and jobs act imposed a 10000 cap on the itemized deduction for state and local taxes from 2018 through 2025.

State and local taxation administration and policy as with most aspects of the economy were molded in. I am not going to support any change in the tax code unless.

Letter Argument Against Salt Tax Repeal Misleading

How Dems Can Get Out Of The Salt Mess And Save 1 Trillion

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

These States Offer A Workaround For The Salt Deduction Limit

Some Democrats Want To Repeal Salt Tax Deduction Cap But Others Say That S A Tax Cut For The Rich Cbs News

House Democrats Push For Repeal Of Rule Blocking Salt Cap Workaround

72 500 Salt Cap Is Costly And Regressive Committee For A Responsible Federal Budget

State And Local Tax Deduction Salt Deduction Analysis Tax Foundation

Cuomo Murphy Urge Congress To Cut The Salt Deduction Killing New York New Jersey Taxpayers Amnewyork

Pass Through Entity Tax Treatment Legislation Sweeping Across States Forvis

Salt Cap Repeal Democrat Tax Plan Will Benefit Top Earners In High Cost Areas Bloomberg

U S Lawmakers Pepper Congress With Pleas For Salt Tax Break Florida Phoenix

Democrats Push For Agreement On Tax Deduction That Benefits The Rich The New York Times

U S House Passes Legislation To Repeal Salt Deduction Cap For Two Years Focus Turns To Senate Efforts

Latest Proposal From Senate Democrats Would Bar The Rich From Salt Cap Relief Itep

Senator Pat Toomey On Twitter Restoring The Salt Deduction Would Once Again Force Low And Middle Income People To Subsidize Wealthy Individuals In High Tax States And Municipalities Don T Take My Word

Salt Cap Repeal Would Overwhelmingly Benefit High Income Households

Democrats Consider Salt Relief For State And Local Tax Deductions